Electronic Transformer Prices Explained: What Affects the Cost in 2025?

Are you puzzled by the fluctuating prices of electronic transformers? You’re not alone. Many industry professionals are struggling to understand the complex factors shaping transformer costs in 2025.

Electronic transformer prices in 2025 are influenced by raw material costs, technological advancements, global supply chain dynamics, sustainability regulations, and market demand. Understanding these factors is crucial for businesses to make informed decisions and manage their budgets effectively.

As someone who has been in the electronic transformer industry for over two decades, I’ve witnessed firsthand how these factors interplay to determine prices. Let’s dive into the key elements that will shape transformer costs in 2025.

Raw Material Trends: The Foundation of Electronic Transformer Pricing in 2025?

Have you noticed the wild swings in raw material prices lately? These fluctuations are set to play a major role in shaping electronic transformer costs in 2025.

Raw material trends, particularly in copper, steel, and rare earth elements, will significantly impact electronic transformer prices in 2025. The increasing demand for these materials across various industries, coupled with potential supply constraints, is likely to drive up costs.

Let me break down how raw material trends are affecting transformer pricing, based on my experience in the industry:

Copper: The Lifeblood of Transformers

Copper is a crucial component in transformer windings. Its price trends have a direct impact on transformer costs:

- Increasing Demand: The growth in electric vehicles and renewable energy sectors is pushing up copper demand.

- Supply Challenges: Copper mining and processing face environmental and geopolitical challenges.

- Price Volatility: Copper prices have shown significant fluctuations, affecting transformer pricing strategies.

In a recent project, we saw copper prices surge by 30% in just six months. This unexpected increase forced us to revise our pricing structure mid-project.

Electrical Steel: The Core Issue

Electrical steel, used in transformer cores, is another key material:

- Specialized Production: High-grade electrical steel requires specialized manufacturing processes.

- Global Supply Constraints: Limited producers worldwide can lead to supply bottlenecks.

- Quality vs. Cost Trade-offs: Higher efficiency transformers require better quality steel, impacting costs.

I remember a situation where a shortage of high-grade electrical steel delayed a major infrastructure project by several months, highlighting the importance of this material.

Rare Earth Elements: The Hidden Cost Driver

Rare earth elements, used in high-efficiency transformers, are becoming increasingly important:

- Limited Sources: Most rare earth elements come from a few countries, creating supply risks.

- Processing Challenges: Refining rare earth elements is complex and environmentally sensitive.

- Technological Demand: Increasing use in various technologies is driving up prices.

Impact of Raw Material Trends on Transformer Pricing

| Material | Price Trend (2025 Projection) | Impact on Transformer Cost |

|---|---|---|

| Copper | Upward (+15-20%) | Significant increase in winding costs |

| Electrical Steel | Moderate increase (+5-10%) | Moderate impact on core costs |

| Rare Earth Elements | Volatile (+10-30%) | Potential spike in high-efficiency transformer costs |

In my experience, these raw material trends don’t just affect prices; they also influence design decisions. For instance, in a recent project, we opted for aluminum windings instead of copper to mitigate cost increases. While this reduced material costs, it required design modifications to maintain performance standards.

Looking ahead to 2025, I anticipate that manufacturers will need to be more creative in their material sourcing and design strategies. This might include:

- Developing alternative materials or composites to reduce dependence on volatile raw materials.

- Implementing more efficient manufacturing processes to offset raw material cost increases.

- Exploring recycling and circular economy principles to reduce reliance on primary raw materials.

Remember, understanding these raw material trends is crucial not just for pricing, but for the entire transformer design and manufacturing process. As we move towards 2025, staying informed about these trends will be key to making smart decisions in transformer procurement and design.

Technology and Innovation: How Advancements are Shaping Transformer Costs?

Are you wondering why some new transformers come with a hefty price tag while others are surprisingly affordable? The answer lies in the rapid pace of technological advancements in the industry.

Technological innovations in electronic transformers, such as advanced materials, smart monitoring systems, and improved efficiency designs, are significantly influencing costs in 2025. While some innovations increase upfront costs, others lead to long-term savings through improved performance and longevity.

As someone who’s been at the forefront of transformer technology for years, I’ve seen how innovations can both drive up costs and create savings. Let’s explore the key technological trends affecting transformer prices:

Advanced Materials: The New Frontier

Innovative materials are revolutionizing transformer design:

- Amorphous Metal Cores: Offer lower losses but come at a higher initial cost.

- High-Temperature Superconductors: Promise incredible efficiency but are still expensive.

- Nano-engineered Insulation: Improves performance but requires specialized manufacturing.

I recently worked on a project using amorphous metal cores. The initial cost was 20% higher, but the energy savings over five years more than made up for it.

Smart Monitoring and Diagnostics

Intelligent systems are becoming standard in modern transformers:

- IoT Sensors: Allow real-time monitoring but add to the component cost.

- AI-driven Diagnostics: Predict failures and optimize performance, requiring sophisticated software.

- Remote Management Capabilities: Enhance operational efficiency but need secure communication infrastructure.

In a large industrial installation, we implemented smart monitoring systems. The upfront cost increased by 15%, but maintenance costs dropped by 30% annually.

Efficiency Improvements

Pushing the boundaries of efficiency affects pricing:

- Advanced Winding Techniques: Reduce losses but require specialized manufacturing.

- Optimized Core Designs: Improve performance but often use more expensive materials.

- Cooling System Innovations: Enhance efficiency and lifespan but add complexity and cost.

Impact of Technology on Transformer Costs

| Technology | Initial Cost Impact | Long-term Cost Impact |

|---|---|---|

| Amorphous Metal Cores | +15-25% | -10-20% (energy savings) |

| Smart Monitoring Systems | +10-20% | -20-30% (maintenance savings) |

| High-Efficiency Designs | +5-15% | -5-15% (operational savings) |

In my experience, the key to navigating these technological advancements is to consider the total cost of ownership, not just the initial price. For instance, a client once balked at the 30% higher price of a high-efficiency transformer with smart monitoring. After we demonstrated the potential 40% reduction in energy and maintenance costs over ten years, they quickly saw the value.

Looking towards 2025, I anticipate several trends:

- Integration of AI and Machine Learning: This will lead to self-optimizing transformers, potentially reducing operational costs but increasing initial investment.

- Modular and Scalable Designs: These will offer more flexibility but may have higher upfront engineering costs.

- Biodegradable and Recyclable Components: As sustainability becomes crucial, these materials might increase initial costs but offer long-term environmental and economic benefits.

It’s important to remember that while these technologies often increase upfront costs, they can lead to significant savings over the transformer’s lifetime. As we approach 2025, the challenge will be balancing the adoption of new technologies with cost considerations, always keeping in mind the long-term benefits and total cost of ownership.

Global Supply Chain Dynamics: Impact on Electronic Transformer Pricing?

Have you ever wondered why the price of electronic transformers can vary so dramatically from one month to the next? A big part of the answer lies in the complex world of global supply chains.

Global supply chain dynamics, including geopolitical tensions, shipping costs, and regional manufacturing shifts, significantly impact electronic transformer pricing in 2025. These factors can lead to sudden price fluctuations and availability issues, making strategic sourcing crucial for manufacturers and buyers.

As someone who’s navigated the choppy waters of international transformer supply for years, I’ve seen firsthand how global events can ripple through the industry. Let’s break down the key supply chain factors affecting prices:

Geopolitical Tensions and Trade Policies

Political landscapes shape the transformer market more than you might think:

- Tariffs and Trade Wars: Can suddenly increase costs or cut off supply routes.

- Sanctions: May limit access to certain materials or technologies.

- Regional Alliances: Can create preferential trading conditions, affecting global prices.

I remember when a sudden tariff increase on imported steel forced us to quickly find new suppliers, leading to a 15% price hike on our transformers almost overnight.

Shipping and Logistics Challenges

The movement of goods globally has become increasingly complex:

- Fuel Costs: Fluctuations in oil prices directly impact shipping costs.

- Container Shortages: Can cause delays and increase transportation expenses.

- Port Congestion: Leads to unpredictable delivery times and additional storage costs.

During the global shipping crisis of 2021, we saw our logistics costs double, forcing us to reevaluate our entire supply chain strategy.

Regional Manufacturing Shifts

The global manufacturing landscape is constantly evolving:

- Labor Cost Differences: Manufacturing may shift to regions with lower labor costs.

- Technological Capabilities: Some regions may develop specialized manufacturing expertise.

- Local Content Requirements: Certain markets may require local production, affecting global supply.

Impact of Supply Chain Factors on Transformer Pricing

| Factor | Short-term Price Impact | Long-term Price Impact |

|---|---|---|

| Geopolitical Tensions | Sudden +/- 5-20% | Gradual shift in supply chains |

| Shipping Challenges | Fluctuations of 10-30% | New logistics strategies emerge |

| Manufacturing Shifts | Initial volatility | Potential cost reductions |

In my experience, successful navigation of these supply chain challenges requires a combination of foresight and flexibility. For instance, when faced with rising shipping costs, we invested in regional manufacturing hubs. This initially increased our capital expenditure but ultimately led to more stable pricing and improved delivery times for our customers.

Looking ahead to 2025, I anticipate several trends in the global supply chain:

- Increased Diversification: Companies will likely spread their supply chains across multiple regions to mitigate risks.

- Localization of Production: More manufacturers may opt for local production to reduce shipping dependencies.

- Digital Supply Chains: Advanced tracking and predictive analytics will help manage supply chain risks more effectively.

It’s crucial to remember that in the world of electronic transformers, a stable and efficient supply chain is as important as the product itself. As we move towards 2025, companies that can adapt quickly to global supply chain dynamics will be better positioned to offer competitive pricing and reliable delivery.

Sustainability and Regulations: The Hidden Costs in Transformer Manufacturing?

Have you noticed the growing emphasis on sustainability in the electronics industry? This trend is set to have a significant impact on electronic transformer prices in 2025.

Sustainability initiatives and stricter regulations are introducing new costs in transformer manufacturing. These include investments in eco-friendly materials, energy-efficient processes, and compliance with environmental standards. While initially increasing prices, these changes may lead to long-term cost savings and market advantages.

As someone who’s been adapting to changing regulations for decades, I’ve seen how sustainability can reshape our industry. Let’s explore the key areas where sustainability and regulations are affecting transformer costs:

Eco-Friendly Materials

The push for greener components is changing our material choices:

- Biodegradable Insulation: More expensive but environmentally friendly.

- Recycled Metals: Can reduce environmental impact but may affect performance.

- Low-Carbon Steel: Produced with less environmental impact but at a higher cost.

In a recent project, switching to biodegradable insulation increased our material costs by 25%, but it opened doors to environmentally conscious clients willing to pay a premium.

Energy-Efficient Manufacturing Processes

Reducing the carbon footprint of production is becoming crucial:

- Renewable Energy in Factories: Requires significant upfront investment.

- Waste Reduction Technologies: Can lead to long-term savings but have high initial costs.

- Heat Recovery Systems: Improve overall efficiency but add to plant complexity.

We recently upgraded our manufacturing plant with solar panels and waste heat recovery systems. The initial investment was substantial, but we’re seeing a 20% reduction in energy costs.

Regulatory Compliance

Keeping up with evolving regulations is a constant challenge:

- Emissions Standards: May require new filtration systems or process changes.

- Chemical Use Restrictions: Can force changes in materials and processes.

- Energy Efficiency Requirements: Often necessitate redesigns of transformer models.

Impact of Sustainability and Regulations on Transformer Costs

| Factor | Initial Cost Impact | Long-term Cost Impact |

|---|---|---|

| Eco-Friendly Materials | +10-30% | Potential premium pricing |

| Energy-Efficient Processes | +15-25% investment | -10-20% operational costs |

| Regulatory Compliance | +5-15% | Varies (market access benefit) |

In my experience, the key to managing these costs is to view sustainability not as a burden, but as an opportunity for innovation and market differentiation. For example, when new efficiency standards were introduced, we invested heavily in R&D. This led to a new line of ultra-efficient transformers that, while 20% more expensive, quickly became our best-sellers due to their lower total cost of ownership.

Looking towards 2025, I anticipate several trends in sustainability and regulations:

- Circular Economy Focus: Expect more emphasis on recyclability and end-of-life management of transformers.

- Carbon Pricing: This could significantly impact manufacturing costs, especially for energy-intensive processes.

- Transparency Requirements: Regulations may demand more disclosure about the environmental impact of products, affecting marketing and potentially pricing.

It’s important to remember that while sustainability initiatives and regulatory compliance often increase short-term costs, they can lead to significant benefits in terms of market access, brand reputation, and long-term cost savings. As we approach 2025, companies that proactively embrace sustainability are likely to gain a competitive edge, even if it means higher initial prices.

Market Forces Unveiled: Demand, Competition, and Customization in 2025 Pricing?

Ever wondered why some transformer models seem to defy normal pricing trends? The answer often lies in the complex interplay of market forces shaping the industry in 2025.

In 2025, electronic transformer pricing is heavily influenced by market demand fluctuations, intense competition among manufacturers, and the growing trend towards customization. These factors can lead to price volatility, with some models seeing price drops due to competition, while others, especially customized solutions, command premium prices.

As someone who’s been riding the waves of market changes for years, I’ve seen how these forces can dramatically shift pricing strategies. Let’s dive into the key market factors affecting transformer prices:

Demand Fluctuations

The ever-changing demand landscape keeps us on our toes:

- Emerging Technologies: New applications can suddenly spike demand for specific transformer types.

- Economic Cycles: Industrial growth or slowdowns significantly impact transformer demand.

- Energy Infrastructure Projects: Large-scale initiatives can create sudden demand surges.

I recall when the renewable energy boom hit – demand for certain transformer types doubled almost overnight, leading to temporary price hikes of up to 40%.

Competitive Landscape

The battle for market share intensifies in 2025:

- Global Players vs. Local Manufacturers: Competition between international giants and nimble local producers.

- Technological Edge: Companies with advanced tech can command higher prices or undercut competitors.

- Price Wars: In saturated markets, aggressive pricing strategies can drive down industry-wide prices.

Customization Trends

The move towards tailored solutions is reshaping pricing models:

- Specialized Applications: Unique requirements often justify premium pricing.

- Mass Customization: Balancing personalization with production efficiency.

- Rapid Prototyping: Quick turnaround on custom designs affects pricing strategies.

In a recent project, we developed a highly customized transformer for a cutting-edge quantum computing application. The unique specifications allowed us to charge a 50% premium, despite fierce competition in the standard transformer market.

Impact of Market Forces on Transformer Pricing

| Factor | Price Impact | Market Segment Most Affected |

|---|---|---|

| Demand Surges | +10-30% short term | Emerging tech sectors |

| Intense Competition | -5-15% in mature markets | Standard transformer models |

| Customization | +20-100% for specialized units | High-tech and niche industries |

In my years of experience, I’ve learned that successfully navigating these market forces requires a combination of foresight, flexibility, and strategic positioning. For instance, when we noticed a trend towards more compact transformers in urban development projects, we invested in a new production line for miniaturized models. This allowed us to capture a growing market segment and maintain higher profit margins despite overall price pressures in the industry.

Looking ahead to 2025, I anticipate several key trends in market dynamics:

-

Segmentation Intensification: The market is likely to see further segmentation, with clear distinctions between commodity transformers and high-value, specialized units.

-

Servitization: More companies may shift towards offering transformers as part of a service package, including monitoring, maintenance, and upgrades, potentially changing pricing models.

-

Collaborative Innovation: Partnerships between transformer manufacturers and end-users for co-development of solutions could lead to new pricing structures based on value creation.

-

Dynamic Pricing Models: With the advent of AI and big data, we might see more sophisticated, real-time pricing adjustments based on market conditions and customer profiles.

It’s crucial to remember that in the transformer industry, pricing is not just about cost plus margin. It’s a complex dance of perceived value, market positioning, and strategic goals. As we approach 2025, companies that can adeptly read market signals and quickly adjust their pricing and product strategies will be best positioned to thrive.

For example, in our company, we’ve started implementing a dynamic pricing model for our more standardized transformer lines. This system adjusts prices in real-time based on factors like current demand, competitor pricing, and raw material costs. While it was a significant investment to develop, it’s allowing us to maximize our market share and profitability in an increasingly competitive landscape.

Moreover, we’re seeing a growing trend towards what I call "solution pricing" rather than product pricing. Instead of selling a transformer as a standalone unit, we’re packaging it with installation, maintenance services, and performance guarantees. This approach has allowed us to maintain higher margins by focusing on the overall value we provide, rather than competing solely on the upfront cost of the transformer.

As we look to the future, I believe that success in the transformer market will increasingly depend on a company’s ability to not just react to market forces, but to anticipate and shape them. This might involve investing in emerging technologies, even before the market demand is clear, or developing innovative pricing models that align with evolving customer needs.

Remember, in the world of electronic transformers, price is often a reflection of value. As we move towards 2025, the companies that will lead the market are those that can clearly articulate and deliver value, whether through technological innovation, customization capabilities, or comprehensive service offerings.

Conclusion

The pricing of electronic transformers in 2025 is shaped by a complex interplay of factors including raw material trends, technological advancements, global supply chains, sustainability requirements, and market dynamics. Understanding these elements is crucial for navigating the evolving landscape of transformer manufacturing and procurement.

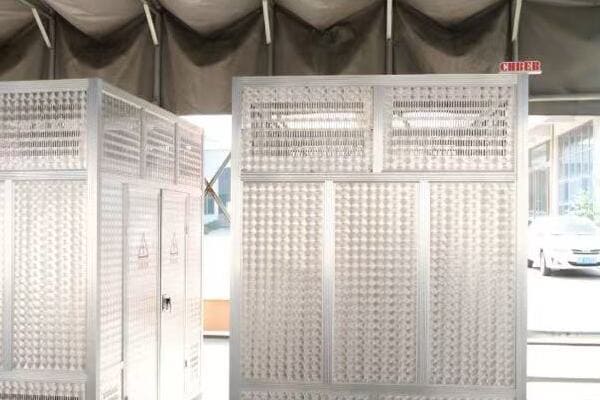

Free CHBEB Transformer Catalog Download

Get the full range of CHBEB transformers in one catalog.

Includes oil-immersed, dry-type, pad-mounted, and custom solutions.

Quick Message

Request A free quote

- +86 15558785111

- [email protected]

- +86 15558785111

CHINA BEI ER BIAN (CHBEB) GROUP, with 218 million in registered capital, originated from Beijing Beierbian Transformer Group. Headquartered in Beijing for R&D, it operates major production bases in Nanjing and Yueqing, producing high-quality products.

No 3,RongJing East Road,BeiJing Economic Technological Development Area,BeiJing,China

No 7️Xiangfeng Road,Jiangning,NanJing,JiangSu,China

No.211, Wei 16 Road, Industrial Zone, Yueqing, Wenzhou, Zhejiang, China.

XiangYang Industrial Zone ,YueQing,WenZhou,ZheJiang,China

- [email protected]

- +86 13057780111

- +86 13057780111

- +86 15558785111

Copyright © Bei Er Bian Group