2025 China Transformer Brand Analysis | Top Manufacturers & Buyer’s Guide | CHBEB

Introduction

Picking the wrong brand could mean lost time and money. China’s market is busy and moves quickly, which makes things even more confusing. With proven market drivers, objective brand profiles, and a useful decision framework, this book helps you limit down your options.

Part 1: The Market Landscape and Important Brand Profiles

An overview of the China Transformer Market and its main drivers in 2025

When planners neglect structural drivers, projects come to a halt. If you don’t spend enough in the grid and renewables, you can end up with old specs. The solution is to base choices on demand indications from 2025.

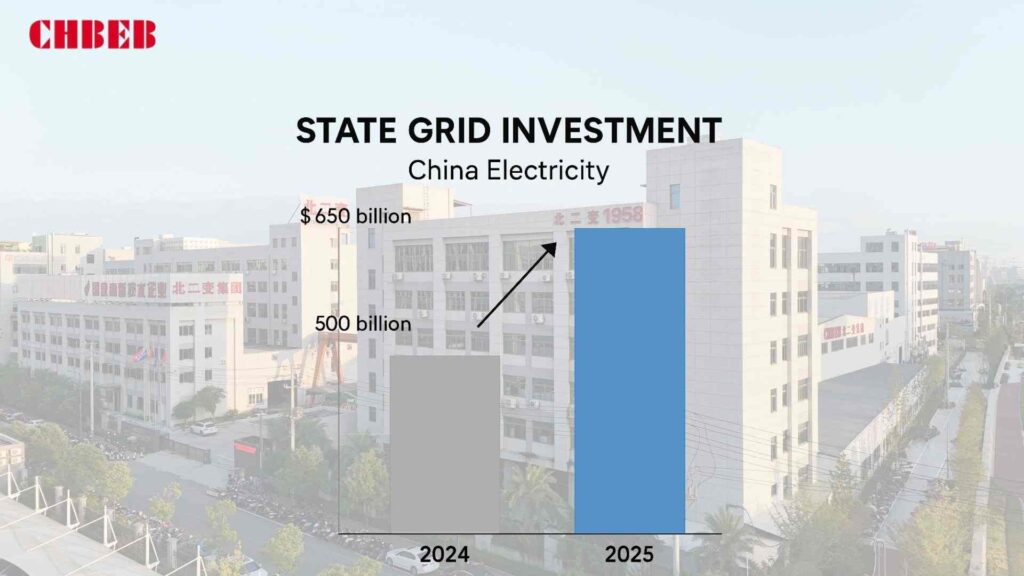

- State Grid1 aims to invest more than ¥650 billion (~$88.7 billion) in 2025 to improve transmission and distribution. This is after spending more in 2024. Reuters

- Explosive Renewables: In 2025, China installed more than 1,000 GW of solar power, which made the need for high-reliability grid and step-up transformers even greater. The Magazine for Transformers

- UHV Build-out: Ongoing UHV AC/DC corridors, including mixed-energy lines for new-energy bases, keep HV/EHV transformers in focus. People’s Daily

What it means: Specifications are moving toward fewer losses, greater ratings, digital monitoring, and being ready for UHV/HVDC.

Market Leaders: The Big Companies in the U.S. That Are Running National Projects

Choosing vendors that are too small can cause delays. If you don’t pay attention to national winners, you miss out on proven UHV capacity and auction victories. Solution: create a list of state-linked and big private leaders with proven scale.

- China XD2 Group is a state-owned company that makes transformers up to 1100 kV and has large research and development and testing labs. It is the main supplier for UHV/GRID projects.

- TBEA is a major player in UHV/HVDC and a supplier to the State Grid for both transmission and integrating renewables (a lot of people in the China market talk about them). Mordor Intelligence

- Baoding Tianwei Baobian Electric makes large-scale power and UHV AC/DC transformers. It is listed in Shanghai and has been in business for a long time in the >500 kV segments.

- JSHP Transformer is a major exporter of power transformers (up to hundreds of MVA) with a significant global presence and exports.

Why they are in the lead: their capacity, their experience with domestic projects, and their ability to bid on State Grid/CSG projects, which will continue in 2025. news.metal.com

Technology and the High-End Market: The Big Companies in China

If you think “foreign = always better,” you’re wasting money; if you don’t, you could lose efficiency over time. It’s important to find a balance.

- Siemens Energy offers high-end power and dry-type portfolios, as well as digital services. They are also still investing in transformer capacity.

- Hitachi Energy (previously ABB Power Grids) works with several partners in China to use HVDC/dry-type and eco-friendly technology.

- GE Vernova (Grid Solutions) is a company that makes grid equipment and transformers for renewable energy and transmission projects.

- Schneider Electric and Mitsubishi Electric are major players in the Chinese market, especially in distribution and industrial transformers and advanced protection and monitoring. Mordor Intelligence

When to choose: complicated renewables, digitalized plants, strict loss/footprint goals, or service needs that span many countries.

Part 2: Comparing and buying things in several ways

Core Competencies: A Look at Technology, Products, and Segments

Only looking at the price per unit raises the total cost over time. Look at how well the technology fits, the risk of delivery, and the service model.

| Dimension | Chinese Leaders (China XD, TBEA, BTW, JSHP) | International Leaders (Siemens Energy, Hitachi Energy, GE Vernova, etc.) |

|---|---|---|

| Voltage/Scale | Extensive HV/EHV, up to 1100 kV; UHV/HVDC pedigree via State Grid projects. 西电集团 | Broad global portfolio; strong at premium ratings and complex specs. siemens-energy.com |

| Tech Focus | Compliance-driven, robust designs; accelerating low-loss materials and digital add-ons. | Advanced monitoring, eco-fluids, dry-type innovation, HVDC expertise. hitachienergy.com |

| Delivery & Scale | Large local capacity, competitive lead times for grid-standard builds. | Longer scheduling for imported or high-customization units. |

| Pricing | Generally lower CAPEX; strong value for standardized specs. | Higher CAPEX; potential OPEX savings via losses/uptime. |

| References | UHV corridors, national tenders, massive domestic base. news.metal.com | Global flagship projects; strong multinational service networks. siemens-energy.com |

| Best Fit | State-backed infra, standard renewables, utility distribution. | High-spec renewables, industrials with strict LCC targets. |

Buyer’s Guide: How to Choose the Right Brand for Your Project

Redesigns that cost a lot of money happen when the scope and tender documentation aren’t clear. Not doing certification or service checks could cause downtime. Solution: a five-step selection process that takes losses into account.

- What is a scenario and risk tolerance (PAS ≤50 words): Incorrectly scoped voltage, cooling, or environment might add hidden costs over time. Tighten the use case: transmission, substation, plant GSU, or industrial distribution? Make sure you understand the ambient, harmonic profile, noise restrictions, footprint, and grid-code compliance.

- Lock down technical baselines

- Voltage/kVA and duty: GSU vs step-down; overload and backup profile.

- Loss classes: Set GB/IEC targets (like S20) that guarantee no-load/load loss and include penalty clauses.

- Fire safety and site restrictions; ONAN/ONAF/ODAF vs. dry-type; cooling and insulation.

- Standards and tests: IEC/GB, routine/type/special (for example, temperature rise, impulse, and sound).

- Map needs to brands

- Chinese officials want uniform grid builds, more exposure to UHV/HVDC, and speedier local delivery.

- When digitization, eco-fluids, or very low total losses drive payback, international leaders. siemens-energy.com

- Check the market momentum for 2025 (PAS ≤50 words): Old pipeline data messes up schedules. Check the capacity and tender activities, such State Grid’s record spending in 2025 and current UHV procurements, to figure out how much work suppliers have and how long it will take. Reuters

- Do a comparison of lifetime costs (LCC)

- Model the cost of energy for the next 25 to 30 years, together with the site’s tariff forecast.

- Include upkeep, spare parts, digital monitoring, and the chance of an outage.

- Look at the trade-offs between capital expenditures (capex) and kilowatt-hour (kW) loss. A more expensive unit can win on operating expenses (OPEX) in 3–7 years, which is what most industrial tariffs assume.

Checklist for due diligence

- References: Installations with similar duties from 2020 to 2025.

- Factory audits: winding, cutting the core, vacuum drying, and FAT capabilities.

- ISO 9001/14001, IEC type test reports, and GB conformity are all examples of certificates.

- Contracts: Loss assurances with penalties and local service available.

Conclusion

China’s transformer market in 2025 combines scale, speed, and innovation. The choice is no longer just between domestic and international names, but between cost-efficient capacity and premium technology with long-term payback.

Domestic leaders (China XD, TBEA, Baoding Tianwei, JSHP) remain the first choice for UHV/HVDC corridor projects, rapid delivery, and standardized grid builds. They bring proven State Grid references, cost competitiveness, and strong local scale.

International giants (Siemens Energy, Hitachi Energy, GE Vernova, Schneider, Mitsubishi) deliver eco-fluids, digital monitoring, and premium loss profiles, making them ideal for complex renewable integration, multi-country operations, and projects with strict lifecycle cost (LCC) targets.

👉 How to decide:

Map your scenario and risk tolerance: transmission, substation, GSU, or industrial distribution.

Lock down technical baselines: voltage/kVA, loss class, cooling method, and compliance standards.

Compare lifecycle costs (CAPEX + OPEX + downtime risk), not just upfront price.

Verify suppliers with recent references, certificates, and service coverage.

✅ Final takeaway: The best brand is not the biggest logo, but the one that aligns with your technical duty, delivery certainty, and 25-year cost model. In 2025, winners will be those who balance grid-scale capacity with digital reliability.

Learn More

Looking for the right dry-type transformer for your project? Download our latest product catalog or browse our product categories to find reliable solutions tailored to your needs.

Free CHBEB Transformer Catalog Download

Get the full range of CHBEB transformers in one catalog.

Includes oil-immersed, dry-type, pad-mounted, and custom solutions.

Quick Message

Request A free quote

- +86 15558785111

- [email protected]

- +86 15558785111

CHINA BEI ER BIAN (CHBEB) GROUP, with 218 million in registered capital, originated from Beijing Beierbian Transformer Group. Headquartered in Beijing for R&D, it operates major production bases in Nanjing and Yueqing, producing high-quality products.

No 3,RongJing East Road,BeiJing Economic Technological Development Area,BeiJing,China

No 7️Xiangfeng Road,Jiangning,NanJing,JiangSu,China

No.211, Wei 16 Road, Industrial Zone, Yueqing, Wenzhou, Zhejiang, China.

XiangYang Industrial Zone ,YueQing,WenZhou,ZheJiang,China

- [email protected]

- +86 13057780111

- +86 13057780111

- +86 15558785111

Copyright © Bei Er Bian Group