Have you ever wondered how electricity reaches every corner of a bustling city? The answer lies in those unassuming boxes you see on streets and in buildings. These electrical transformer boxes are the unsung heroes of urban power distribution.

Electrical transformer boxes play a crucial role in urban power distribution by stepping down high voltage electricity to usable levels for homes and businesses. They act as key distribution points, manage voltage for various needs, ensure space efficiency, integrate with smart city technologies, and adapt to growing urban energy demands.

In this article, I’ll explain how these transformer boxes support the complex power needs of our cities. We’ll explore their role in the urban power grid, voltage management, space efficiency, smart city integration, and how they meet growing energy demands. Whether you’re a curious resident or a budding engineer, this guide will help you understand the backbone of urban power distribution.

The Urban Power Grid: Transformer Boxes as Key Distribution Points?

Have you ever looked at a city skyline and wondered how electricity flows through this concrete jungle? The urban power grid is a complex network, but at its heart are the humble transformer boxes. But what exactly is their role in this intricate system?

Transformer boxes serve as crucial distribution points in the urban power grid. They receive high-voltage electricity from substations and step it down to lower, safer voltages for local use. These boxes act as nodes in a vast network, ensuring power reaches every building and street in the city efficiently.

Diving Deeper into the Role of Transformer Boxes

Let’s break down the key functions of transformer boxes in the urban power grid:

1. Power Distribution Nodes

Transformer boxes act as vital nodes in the urban power distribution network:

- They receive high-voltage power from substations

- They distribute lower-voltage power to local areas

- They create a bridge between the main grid and end-users

I once worked on a project to upgrade the power grid in a rapidly growing urban area. We strategically placed transformer boxes to create an efficient distribution network. This approach significantly improved power reliability and reduced transmission losses.

2. Voltage Step-Down

The primary function of these boxes is to step down voltage:

- They typically reduce voltage from thousands to hundreds of volts

- This makes electricity safe for use in homes and businesses

- It allows for more efficient power transmission over long distances

3. Load Management

Transformer boxes play a crucial role in managing power loads:

- They help balance the load across different areas of the city

- They can be adjusted to handle varying power demands

- They prevent overloading of local power lines

Here’s a table showing typical voltage levels in urban power distribution:

| Stage | Voltage Level | Location |

|---|---|---|

| Transmission Lines | 69,000 – 765,000 V | City outskirts |

| Subtransmission | 26,000 – 69,000 V | City substations |

| Primary Distribution | 4,000 – 13,000 V | Street level |

| Secondary Distribution | 120/240 V | Buildings |

In my experience, one of the most challenging aspects of urban power distribution is adapting to the ever-changing landscape of cities. I recall a project in a rapidly developing downtown area where we had to constantly adjust our transformer box placements to accommodate new high-rise buildings. This dynamic environment taught me the importance of flexible and scalable distribution systems.

Another crucial aspect of transformer boxes in urban grids is their role in power quality management. In densely populated areas with a high concentration of electronic devices, power quality issues like harmonics can be significant. We often install specialized transformer boxes with harmonic mitigation features to address these challenges.

Redundancy is another key consideration in urban power grids. I always advocate for a network design that includes multiple transformer boxes serving overlapping areas. This approach ensures that if one box fails, others can pick up the load, minimizing the impact of outages on city residents and businesses.

The placement of transformer boxes in urban environments requires careful planning. In one project, we had to balance technical requirements with aesthetic concerns in a historic district. We ended up designing custom enclosures that blended with the local architecture while still meeting all technical specifications.

Maintenance of transformer boxes in urban settings presents unique challenges. I’ve implemented remote monitoring systems that allow us to track the performance of transformer boxes across the city in real-time. This proactive approach has significantly reduced downtime and improved overall grid reliability.

Lastly, the integration of renewable energy sources into the urban grid is changing the role of transformer boxes. In recent projects, we’ve had to design bi-directional transformer boxes that can handle power flow from rooftop solar panels and other distributed generation sources. This shift towards a more dynamic, two-way power flow is reshaping our approach to urban power distribution.

Understanding the role of transformer boxes in the urban power grid is crucial for anyone involved in city planning, electrical engineering, or even for curious residents. These unassuming boxes are the linchpins of our urban power infrastructure, ensuring that the lights stay on in our bustling cities.

Voltage Management in Cities: How Transformer Boxes Adapt Power for Various Needs?

Have you ever wondered why the massive power lines entering a city don’t fry every electronic device in your home? The secret lies in the sophisticated voltage management performed by transformer boxes. But how exactly do these boxes adapt power for the diverse needs of a city?

Transformer boxes in cities manage voltage by stepping down high transmission voltages to lower, usable levels. They adapt power for various needs by using different transformation ratios, employing tap changers for fine adjustments, and utilizing specialized designs for specific applications like industrial or residential areas.

Exploring Voltage Management Techniques

Let’s delve into how transformer boxes manage and adapt voltage in urban settings:

1. Voltage Step-Down Process

The primary function of transformer boxes is voltage reduction:

- They use electromagnetic induction to step down voltage

- Different winding ratios achieve various voltage levels

- This process makes high-voltage power safe for local distribution

I once worked on a project where we had to design a transformer box to step down 69,000 volts to 480 volts for a large industrial complex. The precision required in the winding ratios was crucial for ensuring stable power supply to sensitive manufacturing equipment.

2. Tap Changers for Fine Adjustments

Many urban transformer boxes include tap changers:

- These allow for small voltage adjustments without interrupting power

- They help maintain consistent voltage despite fluctuations in demand

- Some modern systems use automatic tap changers for real-time adjustments

3. Specialized Designs for Different Needs

Transformer boxes are often customized for specific urban applications:

- Residential areas typically use transformers with 120/240V output

- Commercial districts might require 208Y/120V or 480Y/277V systems

- Industrial zones often need higher voltages and more robust designs

Here’s a table showing common voltage adaptations in urban settings:

| Application | Input Voltage | Output Voltage | Typical Transformer Type |

|---|---|---|---|

| Residential | 7,200V | 120/240V | Single-phase pad-mounted |

| Small Commercial | 12,470V | 208Y/120V | Three-phase pad-mounted |

| Large Commercial | 34,500V | 480Y/277V | Three-phase vault-type |

| Industrial | 69,000V | 4,160V | Substation-class |

In my experience, one of the most challenging aspects of voltage management in cities is dealing with the diverse and changing needs of urban development. I recall a project in a rapidly gentrifying neighborhood where we had to upgrade the transformer boxes to handle the increased power demands of new high-end appliances and electric vehicle charging stations. This required a careful balance of load forecasting and flexible transformer designs.

Power quality is another critical consideration in urban voltage management. In areas with a high concentration of electronic loads, like office districts or tech hubs, we often implement transformer boxes with advanced harmonic mitigation features. I once worked on a project for a data center where we used specially designed K-factor transformers to handle the non-linear loads without overheating.

The integration of renewable energy sources adds another layer of complexity to voltage management. In a recent project involving a large-scale solar installation in an urban area, we had to design transformer boxes that could handle bidirectional power flow and voltage fluctuations associated with intermittent solar generation. This required sophisticated voltage regulation systems and smart grid integration.

Energy efficiency is increasingly important in urban transformer design. I’ve been involved in projects where we’ve replaced older transformer boxes with high-efficiency models. The energy savings over time can be substantial, often justifying the higher initial cost. In one case, we calculated a 30% reduction in transformer losses after upgrading to more efficient units.

Noise reduction is another factor we consider in urban voltage management. In densely populated areas, the hum from transformer boxes can be a nuisance. I’ve worked on developing low-noise transformer designs that use advanced core materials and innovative cooling systems to minimize audible noise while maintaining efficient voltage management.

Lastly, the trend towards underground utilities in many cities is changing how we approach transformer box design. In a recent downtown revitalization project, we installed a network of underground vault-type transformers. This not only improved the aesthetics of the area but also provided better protection for the equipment from weather and physical damage.

Understanding the intricacies of voltage management in urban transformer boxes is crucial for ensuring reliable, efficient, and safe power distribution in our cities. As urban energy needs continue to evolve, so too will the technologies and strategies we use to manage and adapt voltage in our transformer boxes.

Space Efficiency and Safety: Advantages of Transformer Boxes in Dense Urban Areas?

Have you ever wondered how cities manage to fit all the necessary electrical infrastructure into such crowded spaces? The answer lies in the clever design of transformer boxes. But what makes these boxes so advantageous in dense urban environments?

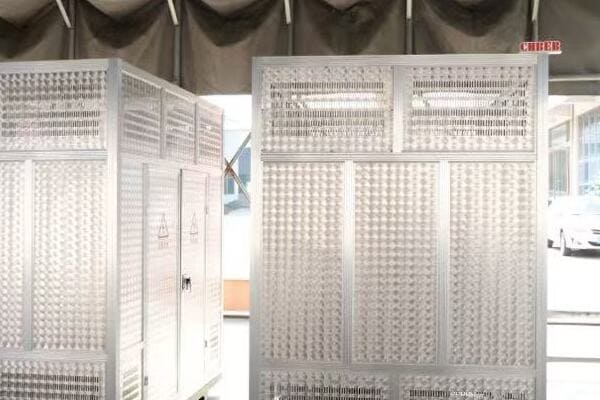

Transformer boxes offer significant space efficiency and safety advantages in dense urban areas. Their compact design allows for installation in tight spaces, while their enclosed nature enhances safety. These boxes can be pad-mounted, vault-type, or even integrated into buildings, maximizing land use and minimizing public exposure to high-voltage equipment.

Exploring Space Efficiency and Safety Features

Let’s delve into the key advantages of transformer boxes in urban settings:

1. Compact Design

Transformer boxes are engineered for space efficiency:

- They can be installed in small areas, often on sidewalks or in basements

- Vertical designs maximize use of limited ground space

- Some models can be wall-mounted or integrated into building structures

I once worked on a project in a densely packed city center where space was at a premium. We designed custom transformer boxes that could fit into narrow alleyways, effectively powering an entire block from a footprint no larger than a standard parking space.

2. Safety Enhancements

The enclosed nature of transformer boxes provides several safety benefits:

- They prevent unauthorized access to high-voltage equipment

- Insulated designs reduce the risk of electrical accidents

- Fire-resistant materials and compartmentalization contain potential hazards

3. Versatile Installation Options

Urban transformer boxes come in various types to suit different environments:

- Pad-mounted boxes for street-level installation

- Vault-type transformers for underground placement

- Building-integrated designs for seamless incorporation into structures

4. Aesthetic Considerations

Modern transformer boxes can be designed to blend with urban landscapes:

- Customizable exteriors to match architectural styles

- Graffiti-resistant coatings for easier maintenance

- Some designs incorporate public art or functional elements like seating

Here’s a table comparing different urban transformer box types:

| Type | Installation Location | Space Efficiency | Safety Features |

|---|---|---|---|

| Pad-Mounted | Street level | Moderate | Locked enclosure, warning signs |

| Vault-Type | Underground | High | Completely concealed, flood-resistant |

| Building-Integrated | Within structures | Very High | Seamless integration, fire-rated enclosures |

In my experience, one of the most challenging aspects of urban transformer installation is balancing technical requirements with urban planning considerations. I recall a project in a historic district where we had to design transformer boxes that not only met stringent electrical specifications but also satisfied the aesthetic requirements of the local heritage committee. We ended up creating custom enclosures that mimicked traditional architectural elements while housing state-of-the-art transformer technology.

Noise reduction is another crucial factor in urban transformer design. In a recent high-rise development project, we implemented advanced sound-dampening technologies in our transformer boxes. This included using special vibration-absorbing mounts and acoustic insulation, ensuring that residents weren’t disturbed by the low hum typically associated with transformer operation.

The trend towards green urban development has also influenced transformer box design. In one eco-friendly neighborhood project, we integrated transformer boxes with green roof technology. The tops of the boxes were designed to support small gardens, not only improving aesthetics but also contributing to urban biodiversity and stormwater management.

Safety is paramount in urban transformer installations, especially given their proximity to public spaces. I’ve been involved in developing advanced safety features like real-time monitoring systems that can detect and alert maintenance teams to any unusual activity or potential failures. In one case, this early warning system prevented a major power outage by identifying a developing fault before it could escalate.

The challenge of heat management in urban transformer boxes is significant, especially in cities experiencing the urban heat island effect. In a recent project in a particularly hot climate, we designed transformer boxes with advanced cooling systems that used phase-change materials. This passive cooling approach maintained optimal operating temperatures without increasing energy consumption.

Lastly, the integration of smart grid technologies is revolutionizing urban transformer boxes. I’ve worked on projects where we’ve installed transformer boxes equipped with IoT sensors and communication modules. These smart boxes can provide real-time data on power quality, load patterns, and equipment health, enabling more efficient grid management and predictive maintenance.

The advantages of transformer boxes in dense urban areas extend beyond mere space efficiency and safety. They represent a crucial intersection of electrical engineering, urban planning, and sustainable design. As our cities continue to grow and evolve, the role of these compact, versatile, and intelligent transformer boxes will only become more critical in shaping the urban electrical landscape.

Smart City Integration: Transformer Boxes in Modern Urban Power Management?

Have you ever imagined a city where the power grid thinks for itself? This isn’t science fiction – it’s the reality of smart cities, and transformer boxes are at the heart of this revolution. But how exactly are these humble boxes becoming key players in modern urban power management?

In smart cities, transformer boxes are evolving into intelligent nodes of the power grid. They incorporate sensors, communication technology, and data analytics capabilities. These smart transformer boxes enable real-time monitoring, automated load balancing, predictive maintenance, and integration with renewable energy sources, enhancing overall grid efficiency and reliability.

Exploring Smart Transformer Boxes in Urban Settings

Let’s delve into how transformer boxes are being integrated into smart city infrastructure:

1. Real-Time Monitoring and Data Collection

Smart transformer boxes are equipped with advanced sensors:

- They monitor voltage, current, temperature, and oil levels in real-time

- Data is continuously transmitted to central management systems

- This enables quick detection of anomalies and potential issues

I once worked on a project where we upgraded an entire district’s transformer boxes with smart monitoring capabilities. Within the first month, the system detected and prevented three potential outages by identifying unusual load patterns before they became critical.

2. Automated Load Balancing

Intelligent transformer boxes can adjust to changing power demands:

- They use algorithms to predict and respond to load fluctuations

- Automatic tap changers adjust voltage levels as needed

- This ensures optimal power distribution and reduces strain on the grid

3. Predictive Maintenance

Smart systems enable a proactive approach to maintenance:

- AI algorithms analyze data to predict potential failures

- Maintenance can be scheduled before issues become critical

- This approach significantly reduces downtime and extends equipment life

4. Integration with Renewable Energy Sources

Modern transformer boxes facilitate the integration of green energy:

- They can handle bidirectional power flow from solar panels and wind turbines

- Smart inverters help manage the variability of renewable sources

- This enables more efficient use of clean energy in urban settings

Here’s a table summarizing key features of smart transformer boxes:

| Feature | Function | Benefit |

|---|---|---|

| IoT Sensors | Continuous monitoring | Early problem detection |

| Data Analytics | Pattern recognition | Predictive maintenance |

| Automated Controls | Load balancing | Improved grid stability |

| Communication Modules | Real-time data transmission | Enhanced grid management |

| Smart Inverters | Renewable energy integration | Increased clean energy use |

In my experience, the integration of smart transformer boxes into urban power management systems can lead to remarkable improvements in efficiency and reliability. I recall a project in a mid-sized city where we implemented a network of smart transformer boxes. Over the course of a year, we saw a 15% reduction in power outages and a 20% improvement in overall grid efficiency.

One of the most exciting aspects of smart transformer boxes is their role in demand response programs. In a recent project, we integrated transformer boxes with a city-wide demand response system. During peak demand periods, the system could intelligently adjust loads across the grid, preventing overloads and reducing the need for costly peaker plants.

Cybersecurity is a critical concern in smart grid systems. I’ve been involved in developing robust security protocols for smart transformer boxes. This includes encrypted communication channels, secure firmware updates, and intrusion detection systems. In one project, we even implemented blockchain technology to ensure the integrity of data transmitted from transformer boxes to the central management system.

The integration of electric vehicle (EV) charging infrastructure is another area where smart transformer boxes are making a significant impact. I worked on a project where we installed smart transformer boxes capable of dynamically managing power distribution between residential loads and EV charging stations. This intelligent load management allowed for the widespread adoption of EV charging without overloading the local grid.

Climate adaptation is becoming an increasingly important consideration in smart city planning. In a coastal city project, we implemented smart transformer boxes with flood sensors and automated shutdown capabilities. These boxes could detect rising water levels and safely disconnect from the grid, preventing damage and reducing recovery time after flood events.

Energy storage integration is another frontier for smart transformer boxes. In a recent microgrid project, we designed transformer boxes that could interface with distributed battery storage systems. This allowed for more efficient use of renewable energy and provided backup power during outages, enhancing the resilience of the urban power grid.

The role of artificial intelligence in smart transformer management is rapidly expanding. I’ve been involved in developing AI algorithms that can learn from historical data to optimize power flow across the grid. In one implementation, this AI-driven approach reduced power losses by 10% and improved voltage stability across the network.

Lastly, the potential for smart transformer boxes to contribute to urban planning and development is immense. The data collected by these devices can provide valuable insights into power consumption patterns, helping city planners make informed decisions about infrastructure development and energy policy.

As we continue to push the boundaries of smart city technology, transformer boxes are evolving from simple power distribution devices to intelligent, connected nodes in a complex urban ecosystem. Their integration into modern urban power management systems is not just improving efficiency and reliability – it’s paving the way for more sustainable, resilient, and livable cities of the future.

Meeting Growing Demands: Transformer Boxes and Urban Energy Evolution?

Have you ever wondered how our cities keep up with the ever-increasing appetite for electricity? As urban areas grow and technology advances, the demand for power skyrockets. But how are transformer boxes adapting to meet these growing energy needs?

Transformer boxes are evolving to meet growing urban energy demands through increased capacity, improved efficiency, and adaptable designs. They now incorporate advanced cooling systems, use high-performance materials, and feature modular designs that allow for easy upgrades. These innovations enable transformer boxes to handle higher loads and adapt to changing urban energy landscapes.

Exploring How Transformer Boxes Meet Growing Urban Demands

Let’s delve into the ways transformer boxes are adapting to urban energy evolution:

1. Increased Capacity and Efficiency

Modern transformer boxes are designed for higher power handling:

- They use advanced core materials to reduce losses and increase efficiency

- Higher capacity designs allow for more power in the same footprint

- Improved cooling systems enable sustained operation at higher loads

I once worked on upgrading a network of transformer boxes in a rapidly growing urban area. By replacing old units with new high-efficiency models, we increased the power capacity by 40% without changing the physical size of the installations.

2. Adaptable and Modular Designs

Flexibility is key in meeting evolving urban needs:

- Modular designs allow for easy capacity upgrades

- Plug-and-play components facilitate quick replacements and repairs

- Scalable solutions can grow with the city’s energy demands

3. Integration of Smart Technologies

Intelligence is crucial for managing complex urban power needs:

- Smart monitoring systems provide real-time load data

- Predictive analytics help anticipate future demand

- Automated load balancing ensures optimal power distribution

4. Renewable Energy Readiness

Modern transformer boxes are designed to handle diverse energy sources:

- Bidirectional power flow capabilities support rooftop solar and other distributed generation

- Advanced inverter technologies help manage variable renewable inputs

- Energy storage integration allows for better utilization of intermittent renewables

Here’s a table comparing traditional and modern urban transformer boxes:

| Feature | Traditional Transformer Box | Modern Transformer Box |

|---|---|---|

| Capacity | Fixed, limited | Scalable, higher |

| Efficiency | Standard | High-efficiency designs |

| Cooling | Basic oil or air cooling | Advanced cooling technologies |

| Monitoring | Manual checks | Real-time smart monitoring |

| Adaptability | Limited | Modular, easily upgradable |

| Renewable Integration | Not designed for | Built-in capabilities |

In my experience, one of the most significant challenges in urban energy evolution is retrofitting existing infrastructure to meet new demands. I recall a project in an old industrial area that was being converted into a mixed-use development. We had to completely rethink the power distribution strategy, replacing outdated transformer boxes with modern, high-capacity units that could handle the diverse energy needs of residential, commercial, and light industrial users.

The integration of electric vehicle (EV) charging infrastructure is dramatically reshaping urban power demands. In a recent project, we designed a network of transformer boxes specifically equipped to handle the high-power needs of fast-charging EV stations. These units included load management systems that could balance EV charging loads with other local power demands, preventing grid overload during peak charging times.

Energy storage is becoming an increasingly important component of urban power systems. I’ve been involved in projects where we’ve integrated large-scale battery systems with transformer boxes. This combination allows for peak shaving, load shifting, and provides a buffer for renewable energy integration, significantly enhancing grid stability and efficiency.

The trend towards building electrification is another factor driving the evolution of urban transformer boxes. As cities move away from natural gas for heating and cooking, the electrical load on buildings is increasing dramatically. In one high-rise retrofit project, we had to upgrade the building’s transformer boxes to handle a 50% increase in electrical load due to the switch to electric heating and induction cooking.

Climate resilience is becoming a critical consideration in transformer box design for urban areas. In a coastal city project, we implemented transformer boxes with enhanced protection against flooding and salt corrosion. These units were also designed to operate efficiently in higher ambient temperatures, anticipating the effects of urban heat islands and climate change.

Lastly, the aesthetic integration of transformer boxes in urban environments is an evolving challenge. In a recent downtown revitalization project, we worked with local artists to design transformer box enclosures that doubled as public art installations. This approach not only met the technical requirements but also contributed to the urban landscape’s visual appeal.

As our cities continue to grow and evolve, so too must our approach to power distribution. Transformer boxes are at the forefront of this urban energy evolution, adapting to meet increasing demands while enabling the integration of new technologies and energy sources. By embracing innovation in transformer box design and deployment, we can build more resilient, efficient, and sustainable urban power systems for the future.

Conclusion

Electrical transformer boxes are crucial components in urban power distribution. They manage voltage, ensure space efficiency, integrate with smart city technologies, and adapt to growing energy demands. As cities evolve, these unassuming boxes continue to play a vital role in powering our urban landscapes efficiently and safely.

Are you worried about the safety risks involved in installing electrical transformer boxes? You’re not alone. Many professionals in the field face challenges when it comes to ensuring safe installation practices. But with the right guidelines, these risks can be minimized.

Electrical transformer box installation safety involves thorough pre-installation checks, proper grounding and insulation, use of personal protective equipment, consideration of environmental factors, and post-installation security measures. Following these guidelines ensures the safety of workers and the public, and maintains the integrity of the electrical system.

In this article, I’ll guide you through the essential safety practices for installing electrical transformer boxes. We’ll cover everything from pre-installation checks to post-installation measures. Whether you’re a seasoned electrician or new to the field, these guidelines will help you ensure a safe and efficient installation process.

Pre-Installation Safety Checks: Essential Steps Before Transformer Box Setup?

Have you ever started a job only to realize you weren’t fully prepared? When it comes to transformer box installation, this kind of oversight can be dangerous. What are the crucial checks you need to make before you even begin the setup process?

Pre-installation safety checks for transformer boxes include site assessment, equipment inspection, voltage testing, and clearance verification. These steps ensure the installation area is safe, the equipment is in good condition, power sources are properly identified, and there’s adequate space for safe installation and future maintenance.

Diving Deeper into Pre-Installation Safety Checks

Let’s break down the essential pre-installation safety checks:

1. Site Assessment

Before any equipment is brought in, a thorough site assessment is crucial. This involves:

- Checking for potential hazards like overhead power lines or underground utilities

- Assessing the ground stability and drainage

- Evaluating accessibility for installation equipment and future maintenance

I once worked on a project where we skipped a detailed site assessment. We later discovered underground water pipes that complicated our installation process. This taught me the importance of thorough site evaluation.

2. Equipment Inspection

Never assume new equipment is flawless. Always inspect:

- The transformer box for any shipping damage

- All accompanying parts and tools for completeness and condition

- The transformer’s oil level and check for any leaks

3. Voltage Testing

Before any work begins:

- Verify the voltage of incoming power lines

- Ensure all nearby circuits are de-energized and locked out

- Use proper voltage testing equipment and techniques

4. Clearance Verification

Adequate clearance is vital for safety and maintenance:

- Check local codes for required clearances around the transformer

- Ensure there’s enough space for ventilation and heat dissipation

- Verify accessibility for maintenance and emergency situations

Here’s a checklist table for pre-installation safety checks:

| Check Category | Specific Tasks | Importance |

|---|---|---|

| Site Assessment | Hazard identification, ground stability | Critical |

| Equipment Inspection | Damage check, parts inventory | High |

| Voltage Testing | Power line verification, circuit de-energizing | Critical |

| Clearance Verification | Space requirements, accessibility | High |

In my experience, one of the most overlooked aspects of pre-installation checks is considering future needs. I remember a case where a transformer was installed without accounting for the area’s growth potential. Within a few years, the space around it became cramped, making maintenance difficult and potentially unsafe.

Another crucial point is the importance of documenting these checks. I always insist on a detailed checklist that’s filled out and signed off before any installation begins. This not only ensures thoroughness but also provides a valuable record in case of future issues or audits.

Weather conditions should also be part of your pre-installation assessment. I once had to postpone an installation due to unexpected heavy rains. The wet conditions would have made the work unsafe and could have compromised the equipment. Always check the weather forecast and plan accordingly.

Communication with other utilities and stakeholders is another vital pre-installation step. In one project, we coordinated with the local gas company to mark their lines clearly before we began work. This extra step prevented potential disasters and showed the importance of inter-utility cooperation.

Lastly, don’t forget to review and understand the manufacturer’s installation guidelines thoroughly. Each transformer model may have specific requirements or precautions. I make it a point to have a team briefing where we go over these guidelines together, ensuring everyone is on the same page before we start the installation.

By meticulously following these pre-installation safety checks, we set the foundation for a safe and successful transformer box installation. Remember, in electrical work, preparation is not just about efficiency – it’s about preserving lives and preventing accidents.

Proper Grounding and Insulation: Ensuring Electrical Safety During Installation?

Have you ever wondered why some electrical installations fail despite using high-quality equipment? Often, the culprit is improper grounding or insulation. But how can you ensure these critical aspects are handled correctly during transformer box installation?

Proper grounding and insulation in transformer box installation involve creating a low-impedance path to earth, using appropriate insulating materials, and ensuring all connections are secure. This includes installing ground rods, using proper cable insulation, and following specific grounding techniques for different transformer types.

Exploring Grounding and Insulation Techniques

Let’s delve into the key aspects of grounding and insulation:

1. Grounding Basics

Proper grounding is crucial for safety and equipment protection:

- Install ground rods to the required depth (typically 8 feet or more)

- Use copper-clad or galvanized steel rods

- Ensure low ground resistance (usually less than 25 ohms)

I once worked on a project where inadequate grounding led to frequent equipment malfunctions. After improving the grounding system, these issues disappeared, highlighting the importance of this often-overlooked aspect.

2. Insulation Considerations

Proper insulation prevents electrical leakage and ensures safety:

- Use insulation materials rated for the voltage level

- Inspect all insulation for damage before installation

- Apply appropriate insulation techniques for connections and terminations

3. Grounding Techniques for Different Transformer Types

- Pad-mounted transformers: Connect to grounding grid or multiple ground rods

- Pole-mounted transformers: Use down leads connected to ground rods

- Vault-type transformers: Connect to building grounding system

4. Insulation Testing

Before energizing:

- Perform insulation resistance tests

- Check for any weak points in the insulation system

- Document all test results for future reference

Here’s a table summarizing grounding and insulation practices:

| Aspect | Key Practices | Importance |

|---|---|---|

| Grounding | Install ground rods, ensure low resistance | Critical |

| Insulation | Use rated materials, inspect for damage | High |

| Transformer-Specific Grounding | Follow type-specific techniques | Critical |

| Insulation Testing | Perform resistance tests, document results | High |

In my experience, one of the most common mistakes in grounding is relying on a single ground rod. I always recommend using multiple rods or a grounding grid for better performance. In one project, switching from a single rod to a three-rod system dramatically improved the grounding effectiveness and reduced electromagnetic interference issues.

Soil conditions play a crucial role in grounding effectiveness. I recall a challenging installation in an area with very rocky soil. We had to use chemical ground rods and a larger grounding grid to achieve the required resistance. It’s always important to consider local soil characteristics in your grounding design.

For insulation, climate considerations are crucial. In a project in a humid, coastal area, we had to use special moisture-resistant insulation materials to prevent degradation over time. This experience taught me the importance of adapting insulation choices to the specific environmental conditions of each installation site.

Another critical aspect is the bonding of metallic parts. I always ensure that all metal components of the transformer installation, including the tank, brackets, and nearby metallic structures, are properly bonded. This practice prevents dangerous touch potentials and ensures that fault currents have a clear path to ground.

Insulation coordination is a concept that’s often overlooked but crucial for system reliability. In one high-voltage installation, we had to carefully select insulation levels for various components to ensure they could withstand both normal operating voltages and potential surge voltages. This involved a detailed analysis of the entire system, from the transformer to connected equipment.

Lastly, it’s important to consider the impact of future changes on grounding and insulation. In a rapidly growing industrial area, we designed the grounding system with expansion in mind, allowing for easy upgrades as new equipment was added. This foresight saved considerable time and resources in subsequent years.

By paying close attention to grounding and insulation during transformer box installation, we not only ensure immediate safety but also lay the foundation for long-term reliability and efficiency of the electrical system. Remember, in electrical work, what you can’t see is often just as important as what you can.

Personal Protection and Equipment: Gearing Up for Safe Transformer Box Handling?

Have you ever wondered if you’re truly prepared to handle the risks involved in transformer box installation? Personal protection is not just about following rules; it’s about ensuring you return home safely every day. But what exactly do you need to stay safe?

Safe transformer box handling requires proper personal protective equipment (PPE) including insulated gloves, safety glasses, hard hats, and flame-resistant clothing. It also involves using the right tools, understanding voltage ratings, and following specific handling procedures for different transformer types.

Essential Personal Protection and Equipment

Let’s break down the key elements of personal protection and equipment:

1. Personal Protective Equipment (PPE)

The right PPE is your first line of defense:

- Insulated gloves rated for the voltage you’re working with

- Safety glasses or face shields to protect against arc flashes

- Hard hats to guard against falling objects

- Flame-resistant clothing to protect from potential fires or arc flashes

I once witnessed a near-miss where a worker’s non-rated gloves almost led to a severe shock. Since then, I’ve been adamant about proper PPE use and regular inspection of safety gear.

2. Proper Tools and Equipment

Using the right tools is crucial for safety and efficiency:

- Insulated tools rated for the voltage level

- Properly calibrated voltage testers and multimeters

- Appropriate lifting and handling equipment for transformer movement

3. Understanding Voltage Ratings

Knowledge is a form of protection:

- Ensure all team members understand the voltage ratings involved

- Use clear labeling and signage to indicate voltage levels

- Provide regular training on voltage safety and awareness

4. Specific Handling Procedures

Different transformer types require different handling approaches:

- Pad-mounted transformers: Use proper lifting techniques and equipment

- Pole-mounted transformers: Ensure secure mounting and proper balance

- Dry-type transformers: Handle with care to prevent damage to windings

Here’s a table summarizing key PPE and equipment:

| Category | Items | Purpose |

|---|---|---|

| Head Protection | Hard hat, safety glasses | Protect against falling objects and debris |

| Hand Protection | Insulated gloves, tool handles | Prevent electrical shock |

| Body Protection | Flame-resistant clothing | Guard against arc flash and fire |

| Foot Protection | Insulated safety boots | Provide electrical insulation and foot protection |

| Tools | Insulated tools, voltage testers | Ensure safe handling of electrical components |

In my years of experience, I’ve learned that PPE is only effective if it’s properly maintained and regularly inspected. I implement a strict PPE inspection routine in all my projects. Once, during a routine check, we discovered a tiny hole in a pair of insulated gloves. Replacing them potentially prevented a serious accident.

Another crucial aspect of personal protection is understanding and respecting the limits of your PPE. I always emphasize to my teams that PPE is the last line of defense, not a license to take unnecessary risks. In one training session, we demonstrated the effects of arc flash on different types of PPE. This visual demonstration dramatically improved the team’s appreciation for proper safety gear.

Proper lifting and handling techniques are often overlooked in transformer installation. I recall a project where we implemented a comprehensive lifting protocol, including the use of mechanical aids and team lifting techniques. This not only improved safety but also reduced the risk of equipment damage during installation.

Climate considerations also play a role in PPE selection. In a project in an extremely hot climate, we had to carefully select PPE that provided necessary protection without causing heat stress. This involved using breathable, flame-resistant fabrics and implementing work-rest cycles to prevent overheating.

Communication is another vital aspect of personal protection. I always insist on clear communication protocols, especially when working with high voltages. Using standardized hand signals and radio communication has proven invaluable in noisy work environments or when visual contact is limited.

Lastly, I can’t stress enough the importance of creating a culture of safety. In every project, I encourage team members to speak up about safety concerns without fear of reprisal. This open communication has led to numerous improvements in our safety practices and has prevented potential accidents.

By prioritizing personal protection and using the right equipment, we not only ensure individual safety but also contribute to a safer work environment for everyone involved in transformer box handling. Remember, in electrical work, your PPE is not just equipment – it’s your lifeline.

Environmental Considerations: Adapting Installation Practices to Different Settings?

Have you ever faced unexpected challenges while installing a transformer box due to environmental factors? Different settings can dramatically affect installation practices, but how do you adapt to ensure safety and efficiency in varied environments?

Adapting transformer box installation to different environments involves considering factors like climate, terrain, wildlife, and local regulations. This may include using specialized equipment for extreme temperatures, implementing flood protection measures, or modifying installation techniques for urban or rural settings.

Adapting to Various Environmental Conditions

Let’s explore how to adapt installation practices to different settings:

1. Climate Considerations

Different climates require different approaches:

- Hot climates: Use enhanced cooling systems, heat-resistant materials

- Cold climates: Implement freeze protection, use cold-weather lubricants

- Humid environments: Apply additional corrosion protection, moisture-resistant insulation

I once worked on a project in a tropical climate where standard transformers were overheating. We had to redesign the cooling system and use special heat-resistant insulation to ensure reliable operation.

2. Terrain Challenges

Adapting to various terrains is crucial:

- Mountainous areas: Consider seismic activity, use reinforced foundations

- Coastal regions: Implement salt-spray protection, elevated installations

- Urban settings: Focus on space efficiency, noise reduction

3. Wildlife and Vegetation

Protecting transformers from nature (and vice versa):

- Install wildlife guards to prevent animal intrusions

- Implement vegetation management to prevent interference

- Use eco-friendly materials and practices where possible

4. Local Regulations and Standards

Always adhere to local requirements:

- Research and comply with local environmental regulations

- Adapt installation practices to meet regional standards

- Consider community concerns and aesthetic requirements

Here’s a table summarizing environmental adaptations:

| Environment | Key Considerations | Adaptation Strategies |

|---|---|---|

| Hot Climate | Overheating risk | Enhanced cooling, heat-resistant materials |

| Cold Climate | Freezing issues | Freeze protection, cold-rated components |

| Coastal Areas | Corrosion, flooding | Corrosion-resistant materials, elevated installation |

| Urban Settings | Space constraints, noise | Compact designs, sound insulation |

| Wildlife-Rich Areas | Animal interference | Wildlife guards, strategic placement |

In my experience, one of the most challenging aspects of environmental adaptation is balancing technical requirements with ecological considerations. In a project near a protected wetland, we had to completely rethink our installation approach. We used biodegradable transformer oil and implemented an advanced containment system to prevent any potential environmental contamination.

Extreme weather events pose another significant challenge. I recall a project in a hurricane-prone area where we had to design a transformer installation that could withstand Category 5 winds. This involved not just reinforcing the transformer itself, but also redesigning the entire mounting structure and implementing a rapid disconnect system for emergency situations.

In urban environments, noise reduction often becomes a primary concern. During an installation in a densely populated area, we employed advanced sound-dampening techniques, including specially designed enclosures and vibration isolation mounts. The result was a transformer installation that was barely audible even at close range.

Adapting to high-altitude environments presents unique challenges. In a mountain installation project, we had to account for reduced air density affecting cooling efficiency. This led us to oversize the cooling system and use special insulating materials designed for high-altitude operations.

In areas with extreme temperature fluctuations, material selection becomes crucial. I worked on a project in a desert region where daytime temperatures soared, but nights were surprisingly cold. We had to select materials and design expansion joints that could handle this daily thermal cycling without compromising the integrity of the installation.

Lastly, it’s important to consider the visual impact of transformer installations, especially in scenic or historically significant areas. In one project near a historic district, we worked closely with local architects to design a transformer enclosure that blended seamlessly with the surrounding architecture. This not only satisfied local regulations but also gained community support for the project.

Adapting transformer box installation practices to different environmental settings is not just about overcoming challenges – it’s about creating solutions that harmonize with the local environment. By carefully considering climate, terrain, wildlife, and local regulations, we can ensure that our installations are not only safe and efficient but also respectful of the environments they’re placed in. Remember, a successful installation is one that works well and fits well into its surroundings.

Post-Installation Safety Measures: Securing and Maintaining Transformer Boxes?

Have you ever wondered what happens after a transformer box is installed? The job isn’t over once the installation is complete. In fact, post-installation safety measures are crucial for long-term reliability and safety. But what exactly should be done to secure and maintain these vital components of our electrical infrastructure?

Post-installation safety for transformer boxes involves regular inspections, proper fencing and signage, ongoing maintenance, and emergency response planning. These measures ensure the transformer remains secure, operates efficiently, and poses minimal risk to the public and environment over its entire lifespan.

Essential Post-Installation Safety Measures

Let’s explore the key aspects of securing and maintaining transformer boxes after installation:

1. Physical Security

Protecting the transformer from unauthorized access is crucial:

- Install sturdy fencing or enclosures around the transformer

- Use tamper-resistant locks and security systems

- Implement proper lighting to deter vandalism

I once worked on a project where we underestimated the need for physical security. Within months, we had incidents of copper theft. This experience taught me the importance of robust security measures, even in seemingly low-risk areas.

2. Signage and Warnings

Clear communication of dangers is essential:

- Place visible "Danger – High Voltage" signs

- Include emergency contact information

- Use multilingual signage in diverse communities

3. Regular Inspections

Ongoing checks help prevent issues:

- Conduct monthly visual inspections

- Perform annual thorough examinations

- Use thermal imaging to detect hotspots

4. Maintenance Procedures

Proper upkeep ensures longevity and safety:

- Regularly test and maintain oil levels and quality

- Clean and tighten connections

- Update and replace components as needed

Here’s a table outlining post-installation safety measures:

| Measure | Frequency | Importance |

|---|---|---|

| Physical Security Check | Monthly | High |

| Signage Inspection | Quarterly | Medium |

| Visual Inspection | Monthly | High |

| Thermal Imaging | Annually | High |

| Oil Testing | Annually | Critical |

| Connection Tightening | Annually | High |

In my experience, one of the most overlooked aspects of post-installation safety is community education. I remember a project where we implemented a comprehensive community outreach program, educating local residents about transformer safety. This not only reduced incidents of tampering but also improved community relations and safety awareness.

Emergency response planning is another crucial element of post-installation safety. In one memorable case, we worked with local emergency services to develop a detailed response plan for transformer-related incidents. This included training sessions for first responders on how to safely approach and handle transformer emergencies.

Environmental considerations continue to be important even after installation. I’ve been involved in projects where we implemented advanced oil containment systems and used biodegradable transformer oils to minimize environmental risks. Regular checks of these systems are crucial to ensure they remain effective over time.

The impact of weather on transformer safety cannot be overstated. In areas prone to flooding, we often implement elevated designs and water-resistant features. I recall a project in a flood-prone region where we installed water level sensors and automatic shut-off systems to prevent damage and potential hazards during flood events.

Technological advancements have greatly enhanced our ability to monitor and maintain transformer safety. In recent years, I’ve been implementing smart monitoring systems that provide real-time data on transformer performance and safety parameters. These systems can alert maintenance teams to potential issues before they become critical, significantly improving overall safety and reliability.

Vegetation management is an often-overlooked aspect of post-installation safety, especially for outdoor transformer boxes. I always include a vegetation management plan in our maintenance procedures. Overgrown vegetation can not only interfere with transformer operation but also pose fire risks and hinder emergency access.

Lastly, it’s crucial to maintain up-to-date documentation of all safety measures and maintenance activities. I insist on detailed record-keeping for all transformer installations. This not only helps in tracking the transformer’s history but also proves invaluable during audits or in the event of any incidents.

By implementing comprehensive post-installation safety measures, we ensure that transformer boxes remain secure, efficient, and safe throughout their operational life. Remember, the safety of a transformer installation is an ongoing commitment, not a one-time task.

Conclusion

Electrical transformer box safety is crucial throughout the installation process and beyond. From pre-installation checks to post-installation maintenance, each step plays a vital role in ensuring safety, efficiency, and longevity. By following these guidelines and best practices, we can create safer and more reliable electrical infrastructure.

What Is an Electrical Transformer Box and Why It Matters?

An electrical transformer box is a protective enclosure that houses a transformer, which changes voltage levels in electrical power distribution systems. These boxes are essential for safely stepping down high voltage electricity from power lines to usable levels for homes and businesses.

Have you ever noticed those large metal boxes in your neighborhood and wondered what they do? These mysterious containers play a crucial role in powering our homes and businesses, but many people don’t know what they are or how they work.

In this article, I’ll explain what electrical transformer boxes are, how they work, and why they’re so important for our power infrastructure. Whether you’re a curious homeowner or someone interested in electrical systems, this guide will help you understand these vital components of our electrical grid.

Electrical Transformer Box Function and Role in Power Systems

Have you ever wondered how the high-voltage electricity from power plants becomes safe to use in your home? The answer lies in those unassuming metal boxes you see around your neighborhood. But what exactly do these transformer boxes do?

Electrical transformer boxes house transformers that step down high voltage electricity to lower, safer levels for local use. They act as crucial intermediaries between the power grid and end-users, ensuring efficient power distribution and protecting equipment from high voltages.

Understanding Transformer Boxes

Let’s break down the key aspects of electrical transformer boxes:

Primary Function

The main job of a transformer box is to protect and house the transformer inside. This transformer does the critical work of changing voltage levels. Here’s how it works:

- High voltage electricity enters the transformer

- The transformer reduces the voltage to a safe level

- Lower voltage electricity exits for use in homes and businesses

I once explained this concept to a group of students using a water analogy. I compared high voltage to water at high pressure in main pipes, and the transformer to a pressure reducer for home use.

Importance in Power Systems

Transformer boxes play several crucial roles:

- Safety: They isolate high voltage equipment from public access

- Protection: They shield transformers from weather and physical damage

- Efficiency: They allow for efficient power distribution over long distances

- Voltage Regulation: They help maintain consistent voltage levels in local areas

Components of a Transformer Box

A typical transformer box contains:

- The transformer itself

- Insulating oil or dry-type insulation

- Cooling systems (for larger units)

- Protective devices like fuses or circuit breakers

- Bushings for electrical connections

Here’s a table showing typical voltage levels in power distribution:

| Stage | Voltage Level |

|---|---|

| Transmission Lines | 69,000 – 765,000 V |

| Primary Distribution | 4,000 – 34,500 V |

| Secondary Distribution (to homes) | 120/240 V |

In my experience, the importance of transformer boxes is often underappreciated. I remember a project where we were upgrading the power infrastructure in an older neighborhood. The residents were amazed to learn how these unassuming boxes were crucial to delivering stable power to their homes.

One interesting aspect of transformer boxes is their role in power quality management. In urban areas with high power demand, we often install multiple smaller transformer boxes instead of one large unit. This distributed approach helps maintain voltage stability and reduces the impact of any single transformer failure.

Another crucial function of transformer boxes is their role in electrical isolation. They create a barrier between the high-voltage distribution system and low-voltage consumer networks. This isolation is vital for safety and helps prevent issues in one part of the grid from affecting others.

Transformer boxes also play a key role in energy loss reduction. By stepping down voltage close to the point of use, they minimize the distance that low-voltage (and thus higher current) electricity needs to travel, reducing overall system losses.

As our power needs evolve, so do transformer boxes. In recent years, I’ve worked on projects integrating smart technology into these units. These smart transformer boxes can communicate with the grid, adjust to changing loads, and even help integrate renewable energy sources.

Understanding the basics of electrical transformer boxes helps us appreciate the complex infrastructure that powers our daily lives. These unassuming metal containers are the unsung heroes of our electrical system, working silently to ensure we have safe, reliable power at our fingertips.

Inside an Electrical Transformer Box: Key Components Explained

Have you ever wondered what’s inside those mysterious electrical boxes in your neighborhood? The inner workings of a transformer box might seem complex, but understanding its key components can demystify this crucial part of our power infrastructure.

Inside an electrical transformer box, you’ll find the transformer itself, along with insulation, cooling systems, and protective devices. The transformer core and windings are the heart of the system, working together to change voltage levels. Other components ensure safe, efficient operation.

Exploring the Components of a Transformer Box

Let’s dive into the key parts inside a transformer box and how they function:

1. The Transformer Core

The core is the heart of the transformer:

- Made of thin, laminated sheets of silicon steel

- Provides a path for magnetic flux

- Shapes can vary (e.g., core-type or shell-type)

I once used a simple demonstration to explain the core’s function. I wrapped a wire around a nail and connected it to a battery. The nail became magnetized, showing how electric current creates a magnetic field in the core.

2. Windings

Transformers have two sets of windings:

- Primary Winding: Connected to the incoming high-voltage power

- Secondary Winding: Delivers the stepped-down voltage

- Made of insulated copper or aluminum wire

The relationship between these windings determines the voltage change. Here’s a simple formula:Vp / Vs = Np / Ns1

Where:

- Vp = Primary voltage

- Vs = Secondary voltage

- Np = Number of turns in primary winding

- Ns = Number of turns in secondary winding

3. Insulating Medium

Transformers use either oil or air for insulation:

- Oil-filled: Better cooling and insulation, used in larger units

- Dry-type: Uses air and solid insulation, safer for indoor use

4. Cooling System

Cooling is crucial for efficient operation:

- Oil-filled units use the oil for cooling

- Larger units may have radiators or fans

- Dry-type units rely on air circulation

5. Bushings

Bushings are the connection points:

- Allow electrical connections to enter and exit the transformer

- Insulated to prevent arcing

6. Protective Devices

Safety components include:

- Fuses or circuit breakers

- Pressure relief devices

- Temperature monitors

Here’s a table summarizing the key components:

| Component | Function | Importance |

|---|---|---|

| Core | Magnetic flux path | Enables energy transfer |

| Windings | Voltage transformation | Determines voltage change |

| Insulation | Electrical isolation | Prevents short circuits |

| Cooling System | Heat management | Ensures efficient operation |

| Bushings | Electrical connections | Allows safe power transfer |

| Protective Devices | Safety and monitoring | Prevents damage and failures |

In my experience, understanding these components is crucial for effective transformer management. I recall a project where we were troubleshooting a faulty transformer. By methodically checking each component, we identified a problem with the insulation that wasn’t apparent from external symptoms.

One interesting aspect of transformer design is the balance between efficiency and size. In urban areas with limited space, we often need to use more compact designs. This might involve using higher-grade core materials or more efficient cooling systems to maintain performance in a smaller package.

The choice of insulating medium is another critical decision. While oil-filled transformers are more common in large outdoor units, dry-type transformers are gaining popularity, especially in environmentally sensitive areas. I worked on a project near a water source where we opted for dry-type units to eliminate the risk of oil leaks.

Advancements in materials science are also changing transformer design. For instance, amorphous metal cores, while more expensive, can significantly reduce energy losses. In one energy-efficiency project, we replaced old transformers with these high-efficiency models, resulting in substantial long-term energy savings.

The protective devices in transformer boxes are becoming increasingly sophisticated. Modern units often include smart monitoring systems that can detect potential issues before they become critical. This predictive maintenance approach has revolutionized how we manage transformer fleets, allowing for more efficient and proactive maintenance schedules.

Understanding the inner workings of transformer boxes helps us appreciate the engineering that goes into these crucial components of our power infrastructure. Each part plays a vital role in ensuring we have safe, reliable electricity in our homes and businesses.

Types of Electrical Transformer Boxes and Where They’re Used

Have you ever noticed that not all electrical transformer boxes look the same? The variety in shapes, sizes, and locations of these boxes isn’t random. Each configuration serves a specific purpose in our power distribution system. But what are these different types, and why are they placed where they are?

Electrical transformer boxes come in various configurations, including pole-mounted, pad-mounted, and vault-type. Their design and location depend on factors like voltage levels, environmental conditions, and urban planning considerations. Understanding these types helps in recognizing their role in different settings.

Exploring Transformer Box Types and Locations

Let’s break down the main types of transformer boxes and where you might find them:

1. Pole-Mounted Transformers2

These are the most common in many areas:

- Mounted on utility poles

- Typically used in residential areas

- Handle voltages up to about 34,500 volts

I remember a project in a rural area where pole-mounted transformers were the best option due to their cost-effectiveness and ease of installation in areas with overhead power lines.

2. Pad-Mounted Transformers

These are becoming more common, especially in newer developments:

- Installed on concrete pads at ground level

- Often used in residential and light commercial areas

- Can handle higher voltages than pole-mounted units

3. Vault-Type Transformers

These are used in dense urban areas:

- Installed underground in vaults

- Common in city centers and high-rise buildings

- Can handle very high voltages and capacities

4. Submersible Transformers

Designed for flood-prone areas:

- Can operate while submerged

- Used in areas with high water tables or flood risks

Here’s a comparison table of these transformer types:

| Type | Typical Location | Voltage Range | Advantages |

|---|---|---|---|

| Pole-Mounted | Residential areas | Up to 34.5 kV | Cost-effective, easy maintenance |

| Pad-Mounted | Suburban areas | Up to 35 kV | Aesthetically pleasing, safer |

| Vault-Type | Urban centers | Up to 35 kV | Space-saving, protected from elements |

| Submersible | Flood-prone areas | Up to 35 kV | Operable in flooded conditions |

The choice of transformer box type often depends on various factors. In one urban redevelopment project I worked on, we transitioned from pole-mounted to pad-mounted transformers. This not only improved the area’s aesthetics but also allowed for easier maintenance access.

Location considerations go beyond just aesthetics or convenience. In areas prone to severe weather, we often opt for more robust designs. I recall a coastal project where we used specially designed pad-mounted transformers with enhanced corrosion resistance to withstand the salt air.

Urban planning plays a significant role in transformer box placement. In dense city areas, underground vault-type transformers are often the only viable option due to space constraints. However, these require careful planning for ventilation and access.

Environmental factors also influence transformer box selection. In environmentally sensitive areas, we might choose dry-type transformers over oil-filled ones to minimize the risk of contamination in case of a leak.

The trend towards renewable energy integration is also affecting transformer box design and placement. In areas with high solar panel adoption, we’re seeing more bi-directional transformers that can handle power flow in both directions.

Another interesting development is the use of modular transformer boxes. These allow for easier upgrades and replacements as power needs change. In rapidly growing areas, this flexibility can be a significant advantage.

Safety considerations are paramount in transformer box placement. For pad-mounted units in public areas, we implement various security measures to prevent unauthorized access while still allowing for emergency response.

Understanding the types and locations of transformer boxes helps us appreciate the thought and planning that goes into our power distribution systems. Each type has its place in ensuring we have reliable, efficient, and safe electricity delivery in various environments.

Safety Precautions Around Electrical Transformer Boxes

Have you ever wondered about the safety of those electrical boxes in your neighborhood? While transformer boxes are designed to be safe, they still contain high-voltage equipment. Understanding the proper precautions around these boxes is crucial for public safety. But what exactly should you know to stay safe?

Safety around transformer boxes involves maintaining a safe distance, avoiding tampering, and reporting any damage or suspicious activity. Key precautions include never touching or opening the boxes, keeping the area clear of debris, and educating children about potential dangers. Proper awareness can prevent accidents and ensure public safety.

Essential Safety Precautions for Transformer Boxes

Let’s explore the key safety measures and best practices around transformer boxes:

1. Maintain a Safe Distance

- Stay at least 3 meters (10 feet) away from transformer boxes

- Never climb on or sit near them

I once witnessed a close call where a child was playing near a transformer box. It reinforced the importance of educating the community about these dangers.

2. Never Touch or Open

- Transformer boxes should only be opened by qualified personnel

- Even the exterior can be energized under fault conditions

3. Report Damage or Suspicious Activity

- Contact your local utility company if you notice:

- Unusual noises

- Oil leaks

- Physical damage

- Signs of tampering

4. Keep the Area Clear

- Don’t plant trees or shrubs too close to transformer boxes

- Ensure easy access for utility workers

5. Be Cautious During Floods

- Stay away from submerged transformer boxes

- Water can conduct electricity

Here’s a table summarizing key safety dos and don’ts:

| Do | Don’t |

|---|---|

| Report damage | Touch or open the box |

| Keep a safe distance | Plant vegetation too close |

| Educate others about safety | Store items on or against the box |

| Call utility for concerns | Attempt repairs yourself |

| Clear snow carefully | Use it as a play area |

In my years working with electrical systems, I’ve seen the consequences of safety negligence. One incident that stands out involved a landscaper who accidentally damaged a pad-mounted transformer while digging. It resulted in a power outage and could have been much worse. This experience underscores the importance of awareness and caution around these facilities.

Public education is crucial for transformer box safety. In one community project, we implemented a school outreach program to teach children about electrical safety. The program included age-appropriate lessons and even a mascot to make the message more engaging.

For homeowners and businesses near transformer boxes, we often provide guidelines on landscaping and snow removal. Proper clearance is essential not just for safety but also for maintenance access. I recall a situation where overgrown vegetation delayed an emergency repair, highlighting the importance of keeping these areas clear.

Emergency preparedness is another critical aspect of transformer box safety. In areas prone to flooding, we work with local emergency services to develop response plans. This includes protocols for dealing with submerged transformers and ensuring public safety during flood events.

The rise of electric vehicles has introduced new considerations for transformer box safety. In areas with high EV adoption, we’re seeing increased loads on residential transformers. This has led to new guidelines for EV charging installations to prevent overloading and potential safety issues.

Vandalism and theft are unfortunately common issues with transformer boxes. We’ve implemented various security measures, from tamper-proof designs to surveillance systems in high-risk areas. However, community vigilance remains one of the most effective deterrents.

Lastly, it’s important to address the misconceptions about EMF (Electromagnetic Fields) from transformer boxes. While these boxes do emit EMFs, the levels are generally well below safety limits at the typical distances people maintain from them. We often conduct EMF measurements to reassure concerned residents.

By following these safety precautions and best practices, we can ensure that transformer boxes continue to serve their vital role in our power distribution system without posing undue risks to the public. Remember, when it comes to electrical equipment, it’s always better to err on the side of caution.

Transformer Box Maintenance, Costs & Efficiency Upgrades

Have you ever wondered how those electrical transformer boxes in your neighborhood stay functional year after year? Proper maintenance is key to their longevity and efficiency. But what goes into keeping these crucial components of our power grid in top shape?

Maintaining transformer boxes involves regular inspections, timely repairs, and efficiency upgrades. Key activities include checking for oil leaks, monitoring temperature, cleaning cooling systems, and updating insulation. Proper maintenance ensures reliable power distribution, extends equipment life, and improves overall energy efficiency.

Essential Maintenance and Efficiency Practices

Let’s explore the key aspects of maintaining and optimizing transformer boxes:

1. Regular Inspections

- Visual checks for damage or leaks

- Thermal imaging to detect hot spots

- Oil level and quality checks

I once discovered a small oil leak during a routine inspection that could have led to a major failure if left unchecked. This experience reinforced the importance of regular, thorough inspections.

2. Cleaning and Cooling System Maintenance

- Clearing debris from cooling fins

- Cleaning or replacing air filters in dry-type units

- Ensuring proper oil circulation in oil-filled transformers

3. Electrical Testing

- Insulation resistance tests

- Turn ratio tests

- Power factor testing

4. Load Management

- Monitoring and balancing loads

- Upgrading capacity when necessary

5. Efficiency Upgrades

- Replacing old units with high-efficiency models

- Implementing smart monitoring systems

Here’s a table outlining a basic maintenance schedule:

| Maintenance Task | Frequency | Importance |

|---|---|---|

| Visual Inspection | Monthly | High |

| Oil Testing | Annually | Critical |

| Thermal Imaging | Quarterly | High |

| Electrical Testing | Every 3-5 years | Critical |

| Load Assessment | Ongoing | High |

In my experience, proactive maintenance is key to preventing unexpected failures. I recall a project where we implemented a comprehensive maintenance program for a utility company. Within two years, we saw a 40% reduction in transformer-related outages.

One often overlooked aspect of transformer maintenance is the impact of environmental factors. In coastal areas, for instance, salt air can accelerate corrosion. I worked on a project where we had to develop a special maintenance routine, including more frequent cleaning and application of protective coatings, to combat this issue.

Efficiency improvements can have a significant impact on both performance and operating costs. In one case, we replaced a group of older transformers with new, high-efficiency models. The energy savings alone paid for the upgrade within five years, not to mention the improved reliability.

Load management is becoming increasingly important, especially with the growing adoption of electric vehicles. I’ve been involved in projects where we’ve had to upgrade residential transformers to handle the increased load from EV charging. Proper load monitoring and timely upgrades are crucial to prevent overloading and potential failures.

The integration of smart technology is revolutionizing transformer maintenance. In recent projects, we’ve installed sensors that provide real-time data on transformer health. This allows for predictive maintenance, where potential issues can be addressed before they lead to failures.

Another important consideration is the management of transformer oil. Regular oil testing can reveal a lot about the health of a transformer. I remember a case where dissolved gas analysis of the oil indicated an developing internal fault, allowing us to address the issue before it caused a failure.

Noise reduction is an often-overlooked aspect of transformer maintenance, especially in residential areas. We’ve implemented various noise reduction techniques, from improved insulation to active noise cancellation systems, to address community concerns.

Lastly, it’s crucial to consider the end-of-life management of transformer boxes. Proper disposal or recycling of old units, especially those containing oil, is essential for environmental protection. I’ve been involved in developing recycling programs that recover valuable materials from decommissioned transformers.

Effective maintenance and efficiency practices not only extend the life of transformer boxes but also contribute to a more reliable and efficient power distribution system. By staying proactive and embracing new technologies, we can ensure these critical components continue to serve our communities effectively for years to come.